The subject of how much tax is due on lottery winnings is a matter of concern for many people, especially during the Christmas lottery season. The Christmas lottery, known as the Lotería de Navidad, is one of the most popular and widely played lotteries in Spain, and the tax implications of winning are an important consideration for potential winners.

¿Conoces todos los impuestos que tienes que pagar si te toca la lotería - Source blog.loteriaanta.com

Editor's Notes: Information on "Impuestos Sobre Lotería De Navidad: Descubre La Porción Que Se Lleva Hacienda" published 2 days ago. This article is written to help people understand the tax implications of winning the Christmas lottery in Spain and planning accordingly.

In the case of the 2023 Christmas lottery, the first prize is 400,000 euros per each winning ticket. For numbers that match the winning number but don't match the series, the prize is 125,000 euros per ticket. If you win a prize of 400,000 euros, the tax rate is 20% on the amount that exceeds 40,000 euros. So, you would pay 72,000 euros in taxes, and your net winnings would be 328,000 euros.

For prizes between 40,001 and 300,000 euros, the tax rate is 20%. For prizes between 300,001 and 600,000 euros, the tax rate is 25%.

| Winning amount | Tax rate |

|:--|:--:|

| Up to €40,000 | 0% |

| €40,001 - €300,000 | 20% |

| €300,001 - €600,000 | 25% |

| Over €600,000 | 45% |

FAQs on Christmas Lottery Taxes: Learn the Tax Implications

The Christmas Lottery is a popular tradition in many countries, offering the chance to win substantial prizes. However, it is important to be aware of the tax implications associated with winning the lottery, including the portion that goes to the tax authority.

Lotería de Navidad 2021: Los premios de hasta 40.000 euros estarán - Source www.elmundo.es

Question 1: How much tax is deducted from lottery winnings?

The specific tax rate applicable to lottery winnings varies depending on the jurisdiction in which the lottery is played. In some countries, lottery winnings may be subject to a flat tax rate, while in others, they may be taxed as part of the winner's overall income.

Question 2: What happens if I win a small prize?

In some jurisdictions, small lottery prizes may be exempt from taxation. The threshold for what constitutes a small prize varies, so it is advisable to consult the relevant tax laws or seek professional advice.

Question 3: Are there any deductions or exemptions that can reduce my tax liability?

Depending on the jurisdiction, there may be certain deductions or exemptions available to lottery winners that can reduce their tax liability. These may include expenses incurred in collecting the prize or charitable donations made from the winnings.

Question 4: What happens if I win a large prize and receive it in installments?

In some cases, lottery winners may receive their winnings in installments over a period of time. The tax implications of this can vary depending on the jurisdiction, so it is important to consult with a tax professional to determine how the installments will be taxed.

Question 5: What should I do if I am not sure about the tax implications of my lottery winnings?

If you are unsure about the tax implications of your lottery winnings, it is highly recommended to consult with a qualified tax professional. They can provide personalized advice based on your specific circumstances and ensure that you fulfill your tax obligations correctly.

Question 6: Is there a way to minimize my tax liability on lottery winnings?

While there may not be a way to completely avoid paying taxes on lottery winnings, there are certain strategies that can help minimize the tax liability. These may include investing the winnings in tax-advantaged accounts or making charitable donations. It is important to seek professional advice to determine the most suitable strategy for your situation.

Understanding the tax implications of winning the lottery is crucial to ensure that you meet your tax obligations accurately and avoid any potential penalties. Consulting with a tax professional can help you navigate the tax complexities and maximize your winnings.

Transition to next article section: Financial Planning for Lottery Winners

Tips to Calculate Christmas Lottery Taxes: Find Out the Share Taken by the Tax Agency

The Christmas Lottery is one of the most anticipated draws of the year. The excitement of winning a prize is immense, but it is also important to be aware of the taxes that must be paid on these winnings. This article provides tips to understand the Christmas Lottery tax and calculate the amount that the Tax Agency takes from the prize.

Tip 1: Check if the prize is subject to tax

Not all prizes from the Christmas Lottery are subject to taxation. Prizes less than €40,000 are exempt from withholding. However, any prize greater than €40,000 is subject to a 20% withholding tax, which is automatically deducted by the lottery operator when the prize is claimed.

Tip 2: Calculate the taxable base

The taxable base is the amount on which taxes are calculated. For prizes greater than €40,000, the taxable base is the difference between the prize amount and €40,000. For example, if you win a prize of €50,000, the taxable base would be €10,000 (50,000 - 40,000).

Tip 3: Apply the tax rate

The tax rate for prizes over €40,000 is 20%. This means that for every €100 of the taxable base, €20 will be withheld as tax. Using the example above, the tax withheld would be €2,000 (10,000 x 0.20).

Tip 4: Understand the tax deductions

In some cases, there may be tax deductions that can reduce the amount of tax owed. One such deduction is for habitual residence. If the winner is a resident of Spain, they may be able to deduct a certain percentage of the prize from the taxable base.

Tip 5: Seek professional advice

If you have any doubts about the tax implications of your Christmas Lottery winnings, it is advisable to seek professional advice. A tax advisor can help you calculate the correct amount of tax to be paid and guide you through the process of claiming any applicable deductions.

By following these tips, you can ensure that you understand the Christmas Lottery tax and calculate the amount that the Tax Agency takes from your prize. This information will help you plan for the tax implications of your winnings and avoid any unexpected surprises.

For more detailed information on Christmas Lottery taxes, please refer to the Impuestos Sobre Lotería De Navidad: Descubre La Porción Que Se Lleva Hacienda.

Impuestos Sobre Lotería De Navidad: Descubre La Porción Que Se Lleva Hacienda

Understanding the implications of taxes on Christmas Lottery winnings is crucial to ensure seamless prize collection and avoid unforeseen deductions. Key aspects to consider include tax rates, exemption thresholds, tax calculation methods, proactive tax planning, and implications for small and large lottery wins.

- Tax Rates: 20% for prizes over €40,000.

- Exemption Threshold: No tax on prizes up to €40,000.

- Tax Calculation: Tax is applied to the amount exceeding the €40,000 threshold.

- Tax Planning: Dividing winnings among family members to maximize tax exemptions.

- Small Wins: Tax-free winnings under €40,000.

- Large Wins: Substantial tax deductions for winnings over €40,000.

By understanding these aspects, winners can plan their tax obligations effectively, ensuring they receive the maximum benefit from their Christmas Lottery winnings. It is advisable to consult with a tax professional for personalized guidance and to navigate the complexities of the tax system associated with lottery winnings.

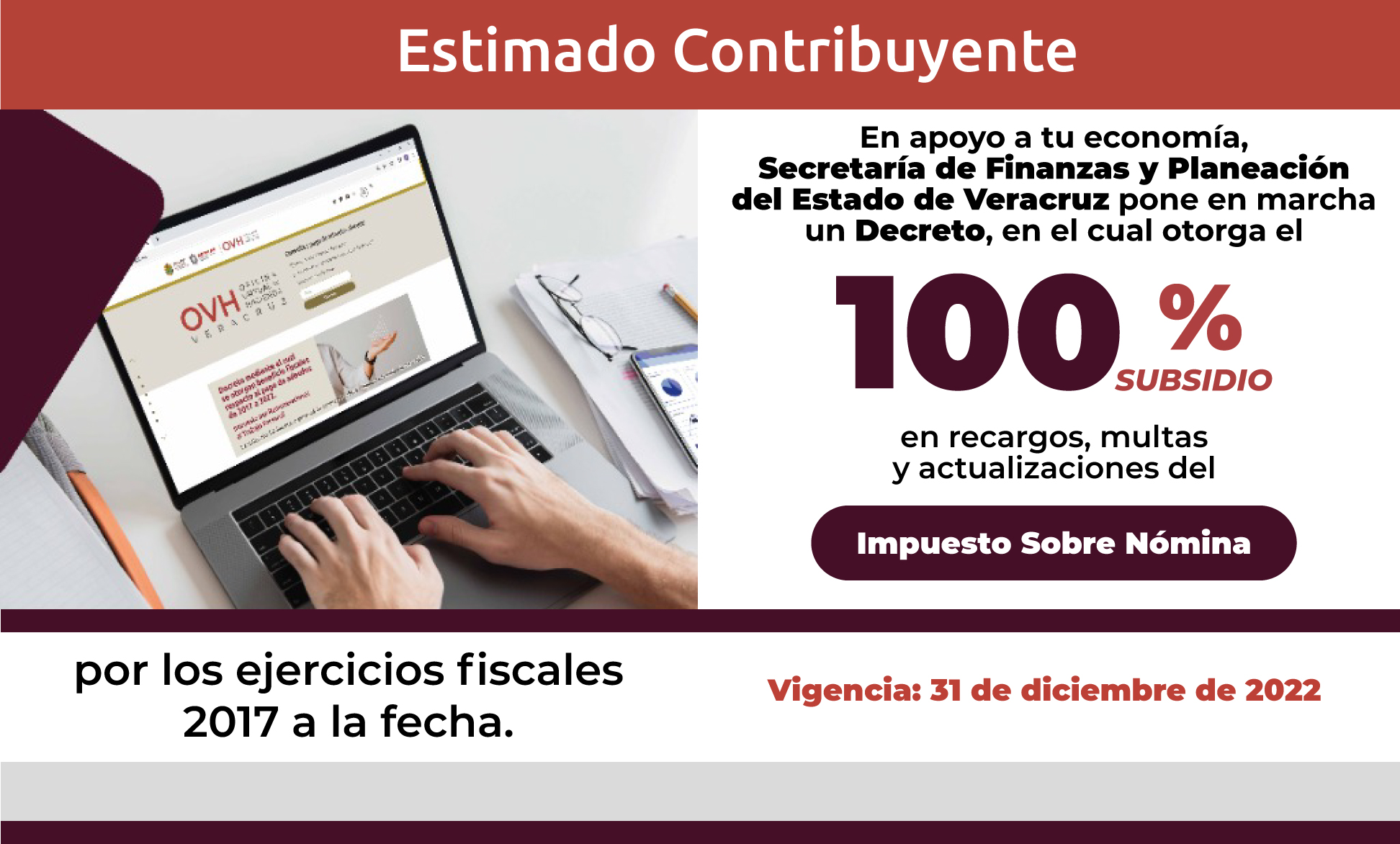

Oficina Virtual de Hacienda | Gobierno del Estado de Veracruz - Source www.ovh.gob.mx

Impuestos Sobre Lotería De Navidad: Descubre La Porción Que Se Lleva Hacienda

The Christmas Lottery is one of the most popular and anticipated events in Spain. Every year, millions of people purchase tickets in hopes of winning a life-changing sum of money. However, what many people don't realize is that the government takes a significant cut of all lottery winnings.

Lotería de Navidad 2022 y Lotería del Niño 2023 ¿Cuántos impuestos hay - Source gefiscal.es

The amount of taxes that you pay on your lottery winnings will depend on the amount of money that you win. For winnings of up to €40,000, you will not have to pay any taxes. However, for winnings of over €40,000, you will be required to pay a 20% tax rate. This means that if you win €100,000, you will have to pay €20,000 in taxes.

It is important to remember that the government takes a significant cut of all lottery winnings. If you are lucky enough to win the lottery, be sure to factor in the taxes that you will have to pay before you start spending your winnings.

Conclusion

The government takes a significant cut of all lottery winnings. For winnings of up to €40,000, you will not have to pay any taxes. However, for winnings of over €40,000, you will be required to pay a 20% tax rate. It is important to remember that the government takes a significant cut of all lottery winnings. If you are lucky enough to win the lottery, be sure to factor in the taxes that you will have to pay before you start spending your winnings.

Remember, just as the lottery can generate financial windfalls, it is also subject to certain tax obligations. Stay informed to ensure a smooth and compliant process when claiming your winnings