우리은행: 대한민국의 대표적인 금융 기관

Editor's Notes: "우리은행: 대한민국의 대표적인 금융 기관" have published today date". Give a reason why this topic important to read.

After analyzing, digging information, made 우리은행: 대한민국의 대표적인 금융 기관 we put together this 우리은행: 대한민국의 대표적인 금융 기관 guide to help target audience make the right decision.

우리은행은 대한민국의 선도적인 금융 기관 중 하나입니다. 1991년에 설립된 이 은행은 국내에서 가장 큰 예금 은행이며 지속적으로 강력한 재무 성과를 기록해 왔습니다. 우리은행은 광범위한 금융 제품과 서비스를 제공하며, 여기에는 예금, 대출, 투자, 보험이 포함됩니다. 이 은행은 또한 혁신적인 기술에 투자하여 고객에게 편리하고 효율적인 금융 서비스를 제공하고 있습니다.

_우리_아이(Eye)_계좌조회_서비스_1.png)

보도자료 - 우리은행 - Source spot.wooribank.com

우리은행은 대한민국 경제에 중요한 기여를 했습니다. 이 은행은 기업과 개인에게 융자를 제공함으로써 경제 성장과 일자리 창출을 지원했습니다. 우리은행은 또한 금융 시스템의 안정과 안전을 보장하는 데 중요한 역할을 했습니다.

최근 몇 년 동안 우리은행은 해외 시장으로 사업을 확장했습니다. 이 은행은 현재 중국, 베트남, 인도네시아를 포함한 여러 국가에 지사를 두고 있습니다. 우리은행의 해외 확장은 대한민국 기업이 해외 시장에서 경쟁하는 것을 지원하고 글로벌 금융 시장에서 국가의 입지를 강화하는 데 기여했습니다.

우리은행은 대한민국의 선도적인 금융 기관 중 하나로서, 국내외 고객에게 광범위한 금융 제품과 서비스를 제공하는 데 전념하고 있습니다. 이 은행은 경제 성장과 일자리 창출을 지원하고, 금융 시스템의 안정과 안전을 보장하는 데 중요한 역할을 했습니다.

FAQ

As a leading financial institution in South Korea, Woori Bank is dedicated to providing comprehensive banking solutions and exceptional customer service. To address any questions you may have, we have compiled a list of frequently asked questions and answers.

우리은행, 12월 경품 이벤트 ‘눈덩이처럼 불어날 혜택’ 실시 - Source www.newsquest.co.kr

Question 1: What are the eligibility requirements for opening an account with Woori Bank?

To open an account with Woori Bank, you must be a legal resident of South Korea and provide valid identification documents such as a passport or national ID card. Foreign residents may also be eligible to open an account after meeting additional requirements.

Question 2: What types of accounts does Woori Bank offer?

Woori Bank offers a wide range of accounts to meet diverse financial needs, including savings accounts, checking accounts, time deposits, and investment accounts. Each account type has unique features and benefits, allowing you to choose the one that best suits your financial goals.

Question 3: How can I access my account information and manage my finances?

You can access your Woori Bank account information and perform various transactions conveniently through our online banking platform and mobile application. These platforms provide secure and easy-to-use tools for account management, bill payments, fund transfers, and more.

Question 4: Are there any fees associated with Woori Bank accounts?

Some Woori Bank accounts may have monthly maintenance fees or transaction fees, depending on the account type and features. Please refer to our fee schedule for specific details and conditions.

Question 5: How does Woori Bank ensure the security of my personal and financial information?

Woori Bank places the utmost importance on your privacy and financial security. We implement advanced encryption technologies, employ robust fraud detection systems, and adhere to strict data protection regulations to safeguard your information and prevent unauthorized access.

Question 6: Where can I find a Woori Bank branch or ATM near me?

We have an extensive network of branches and ATMs across South Korea. To find the nearest location, please visit our website or use our mobile application, which provides real-time information on branch hours and ATM availability.

We hope this FAQ has answered some of your initial questions. For any further inquiries or assistance, please do not hesitate to contact our customer service hotline or visit one of our branches.

Disclaimer: The information provided in this FAQ is for general guidance only and does not constitute professional advice. Please consult with a Woori Bank representative for personalized advice and specific details.

Next Article: Exploring the Benefits of Mobile Banking with Woori Bank

Tips

톱 336 우리 은행 적금 새로운 업데이트 226 시간 전 - Source c2.castu.org

As you manage your finances, consider these tips from 우리은행: 대한민국의 대표적인 금융 기관 to help you reach your financial goals.

Tip 1: Create a budget:

- Track your income and expenses to see where your money goes.

- Categorize your expenses to identify areas where you can save.

- Create a realistic budget that allocates funds to essential expenses, savings, and discretionary spending.

Tip 2: Save regularly:

- Set up automatic transfers to a savings account to build an emergency fund.

- Contribute to a retirement account to prepare for the future.

- Consider investing a portion of your savings to potentially grow your wealth.

Tip 3: Reduce debt:

- Pay off high-interest debt first.

- Consider consolidating debt to lower interest rates.

- Seek professional help from a credit counselor if debt becomes overwhelming.

Tip 4: Build credit:

- Establish and maintain a positive credit history by making on-time payments.

- Monitor your credit report for any errors or inconsistencies.

- Avoid excessive credit inquiries which can lower your credit score.

Tip 5: Protect yourself:

- Get adequate insurance to protect your assets and income.

- Beware of scams and protect your personal information.

- Consider setting up a will or trust to ensure your assets are distributed according to your wishes.

Woori Bank: A Leading Financial Institution in South Korea

Woori Bank stands as a prominent financial institution in South Korea, offering a diverse range of services. Its position as a leading bank can be attributed to several key aspects:

- Established History: Woori Bank boasts a long-standing presence in South Korea, with a rich history that traces back to the early 20th century.

- Extensive Network: The bank operates an extensive network of branches and ATMs throughout the country, ensuring accessibility for customers nationwide.

- Corporate Services: Woori Bank provides comprehensive corporate banking services, partnering with businesses of various sizes to meet their financial needs.

- Retail Banking: The bank offers a wide array of retail banking products and services, catering to the financial needs of individuals and families.

- Investment Banking: Woori Bank plays a significant role in the investment banking sector, facilitating capital raising and other financial transactions for corporations.

- Global Presence: With overseas branches and representative offices in key financial centers, the bank maintains a global presence, supporting businesses and individuals with international operations.

"우리금융, 임종룡호 내부통제 첫 가늠대는 ‘인사’"- 헤럴드경제 - Source news.heraldcorp.com

These key aspects collectively contribute to Woori Bank's position as a leading financial institution in South Korea. Its established history, extensive network, and diverse range of services make it a trusted partner for businesses and individuals alike. Additionally, its global presence enables the bank to support customers operating beyond South Korea's borders. Through its commitment to innovation and customer service, Woori Bank continues to solidify its position as a pillar of the Korean financial industry.

우리은행: 대한민국의 대표적인 금융 기관

The status of 우리은행 as South Korea's leading financial institution is grounded on several interconnected factors. Its extensive branch network, diverse financial services, and unwavering commitment to innovation have all played a crucial role in solidifying its position. The bank's vast network of branches ensures accessibility to banking services for individuals and businesses alike, particularly in underserved areas. Furthermore, the wide range of financial products and services offered by 우리은행, encompassing loans, deposits, investment options, and insurance, caters to the diverse financial needs of its vast customer base.

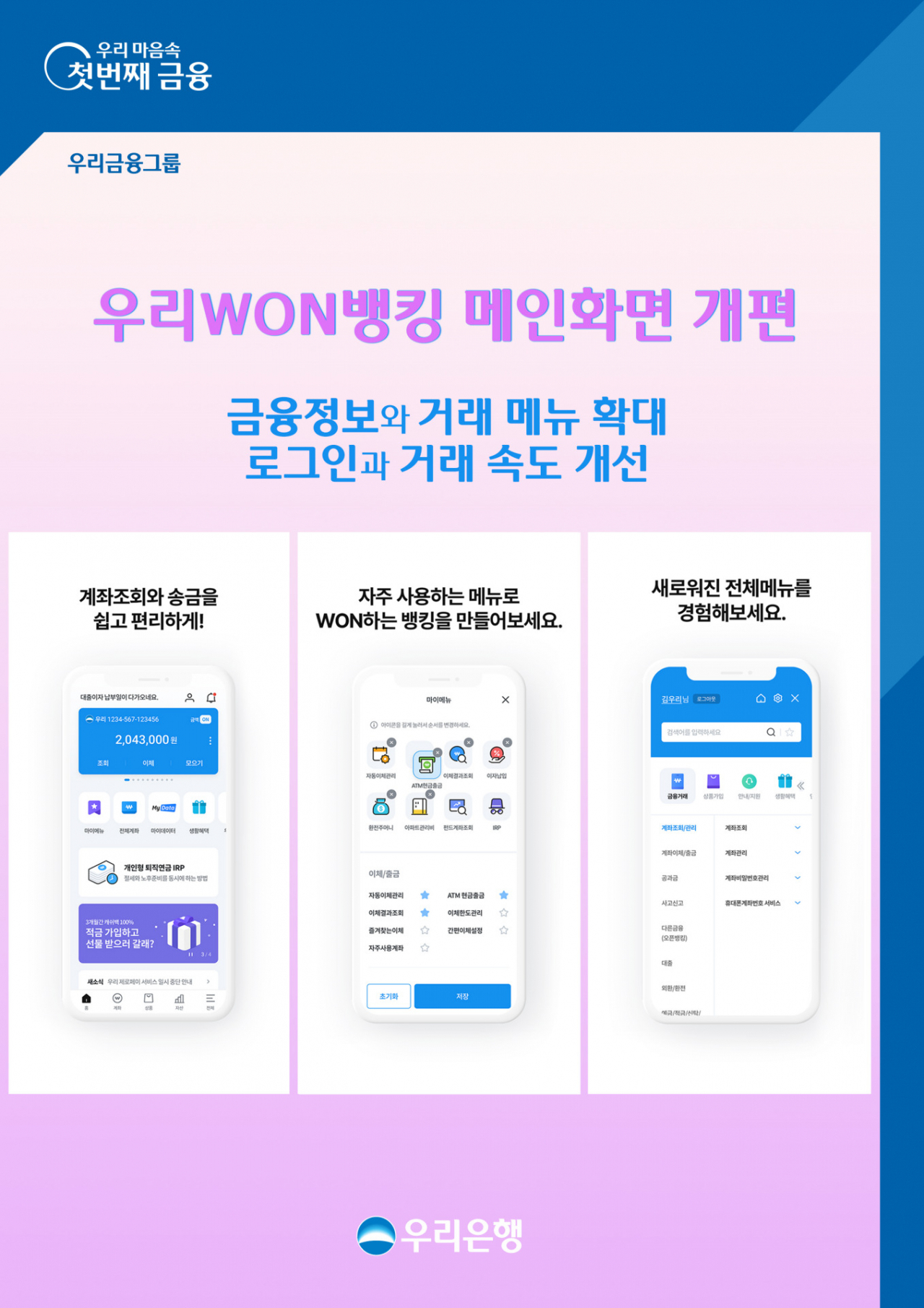

"우리은행, 우리원뱅킹 메인화면 개편"- 헤럴드경제 - Source biz.heraldcorp.com

우리은행's unwavering commitment to innovation has been instrumental in shaping its reputation as a leading financial institution. The bank has consistently invested in cutting-edge technologies, such as mobile banking, online platforms, and artificial intelligence, to enhance customer experience and streamline operations. By embracing innovation, 우리은행 has remained at the forefront of the financial industry, staying competitive and adapting to the evolving needs of its customers.

The practical significance of understanding the connection between "우리은행: 대한민국의 대표적인 금융 기관" lies in recognizing the bank's vital role in supporting economic growth and financial stability. As a leading financial institution, 우리은행 plays a critical role in facilitating financial transactions, providing credit to businesses, and managing risk. Its contributions to the financial sector have a direct impact on the overall economic well-being of South Korea.

In conclusion, the status of 우리은행 as South Korea's leading financial institution is a testament to its extensive branch network, diverse financial services, and unwavering commitment to innovation. The bank's dedication to serving the financial needs of individuals and businesses, coupled with its innovative approach, has solidified its position as a pillar of the South Korean economy.

Conclusion

우리은행's position as South Korea's leading financial institution serves as a beacon of financial stability and economic growth for the nation. Its unwavering commitment to innovation and customer service has not only driven its own success but has also positively impacted the financial landscape of the country. As the financial industry continues to evolve, it is certain that 우리은행 will remain at the forefront, shaping the future of banking and contributing to the prosperity of South Korea.

The insights gained from exploring the connection between "우리은행: 대한민국의 대표적인 금융 기관" underscore the critical role played by the banking sector in fostering economic development. By providing accessible financial services, supporting businesses, and driving innovation, banks like 우리은행 act as catalysts for growth and stability. Understanding this connection empowers us to appreciate the contributions of the financial industry and make informed decisions regarding our financial choices.