Страховые взносы для индивидуальных предпринимателей в 2024 году: размеры и порядок уплаты will be an essential aspect for all self-employed individuals in 2024.

Editor's Notes: Страховые взносы для индивидуальных предпринимателей в 2024 году: размеры и порядок уплаты have published on 24th of February 2023. Individual entrepreneurs need to be aware of the upcoming changes in insurance premium payments

To help our readers understand the upcoming changes, our team has compiled this detailed guide. After analyzing the latest official data and digging into the subject, we have put together this comprehensive guide to help individual entrepreneurs understand the insurance premium payments for 2024.

Key differences or Key takeaways

Transition to main article topics

FAQ - Insurance Contributions for Individual Entrepreneurs in 2024: Amounts and Payment Procedure

This FAQ section provides essential information about insurance contributions for individual entrepreneurs (IEs) in 2024, covering their amounts and payment procedures. Understanding and fulfilling these obligations is crucial for IEs to maintain compliance and secure their social benefits.

Как ИП заплатить страховые взносы в июне 2023 года? | Заметки - Source dzen.ru

Question 1: What are the fixed insurance contribution rates for IEs in 2024?

For 2024, IEs will pay insurance contributions at the following fixed rates: 34,038 rubles for pension insurance, 12,548 rubles for medical insurance, and 4,833 rubles for social insurance against temporary disability and maternity. The total fixed contribution amount is 51,429 rubles.

Question 2: Are there any additional insurance contribution payments for IEs?

In addition to the fixed contributions, IEs with an annual income exceeding 300,000 rubles must make additional pension insurance contributions of 1% on the income amount exceeding this threshold. These contributions are capped at 284,235 rubles.

Question 3: What is the deadline for insurance contribution payments?

Fixed insurance contributions for the year 2024 must be paid by December 31, 2024. The deadline for additional pension insurance contributions is July 1, 2025.

Question 4: How can IEs make insurance contribution payments?

IEs can make insurance contribution payments through their personal account on the website of the Federal Tax Service, mobile banking, or at any bank branch upon providing the necessary details.

Question 5: What are the consequences of late insurance contribution payments?

Late insurance contribution payments result in penalties and fines. The penalty is calculated as 1/300 of the Bank of Russia's refinancing rate for each calendar day of delay.

Question 6: Where can I get help with insurance contribution matters?

For assistance and consultations on insurance contributions, IEs can contact the local branch of the Federal Tax Service or their accountant.

By fulfilling their insurance contribution obligations on time and in full, IEs contribute to their future social security and ensure access to essential benefits, such as pension, medical care, and maternity leave benefits.

For further information and updates on insurance contributions for IEs, please refer to the official website of the Federal Tax Service.

Tips for Understanding and Paying Insurance Contributions for Individual Entrepreneurs in 2024

As an individual entrepreneur, staying informed about insurance contributions and their payment procedures is crucial. Here are a few tips to guide you through the process for 2024:

Tip 1: Determine Your Insurance Contribution Obligations

Based on your projected annual income, calculate the mandatory insurance contributions for pension, health, and social insurance. Refer to the official regulations Страховые взносы для индивидуальных предпринимателей в 2024 году: размеры и порядок уплаты for specific amounts and payment deadlines.

Tip 2: Explore Fixed Insurance Contribution Rates

If your projected annual income is below a certain threshold, you may opt for fixed insurance contribution rates, offering a simplified payment option and potential savings.

Tip 3: Set Up a Payment Schedule

Establish a regular payment schedule to avoid penalties and ensure timely contributions. Consider setting up automatic payments to streamline the process.

Tip 4: Utilize Online Payment Options

Most government agencies offer convenient online payment platforms. Take advantage of these services for quick and secure transactions.

Tip 5: Claim Tax Deductions

Insurance contributions for self-employed individuals are generally deductible from taxable income, reducing your overall tax liability.

Tip 6: Seek Professional Advice if Needed

If you have complex financial circumstances or require further guidance, consider consulting with a tax accountant or financial advisor for personalized assistance.

By following these tips, individual entrepreneurs can navigate the insurance contribution landscape effectively and fulfill their financial obligations in 2024.

Insurance Contributions for Individual Entrepreneurs in 2024: Amounts and Payment Procedure

This article explores the essential aspects related to insurance contributions for individual entrepreneurs in 2024, including their amounts and payment procedure.

- Fixed amount: size unchanged

- Additional amount: based on income

- Tax incentives: tax deductions

- Payment deadlines: quarterly

- Online payment: available platforms

- Consequences of non-payment: penalties and fines

Understanding these aspects is crucial for individual entrepreneurs to meet their legal obligations, minimize tax liability, and secure their social protections.

Пособия, выплаты и взносы для индивидуальных предпринимателей в 2022 - Source www.zarplata-online.ru

Страховые взносы для индивидуальных предпринимателей в 2024 году: размеры и порядок уплаты

The size and procedure of paying insurance premiums for individual entrepreneurs are essential components of the Russian social insurance system. These contributions are mandatory for self-employed individuals and are used to fund various social programs, including pension, medical, and disability insurance. Understanding the regulations and calculations surrounding these premiums is crucial for individual entrepreneurs to ensure compliance and secure their future benefits.

Готовая таблица главных изменений по расчету зарплаты, уплате НДФЛ и - Source 72sodeistvie.ru

The amount of insurance premiums for individual entrepreneurs is determined annually by the Russian government. For 2024, the fixed portion of the contributions for pension insurance is set at 36,792 rubles, while the fixed portion for medical insurance is 8,766 rubles. Additionally, individual entrepreneurs are required to pay a variable portion of insurance premiums based on their income. The variable portion is calculated as a percentage of the entrepreneur's annual income, with a maximum limit set at 365,524 rubles for pension insurance and 286,676 rubles for medical insurance.

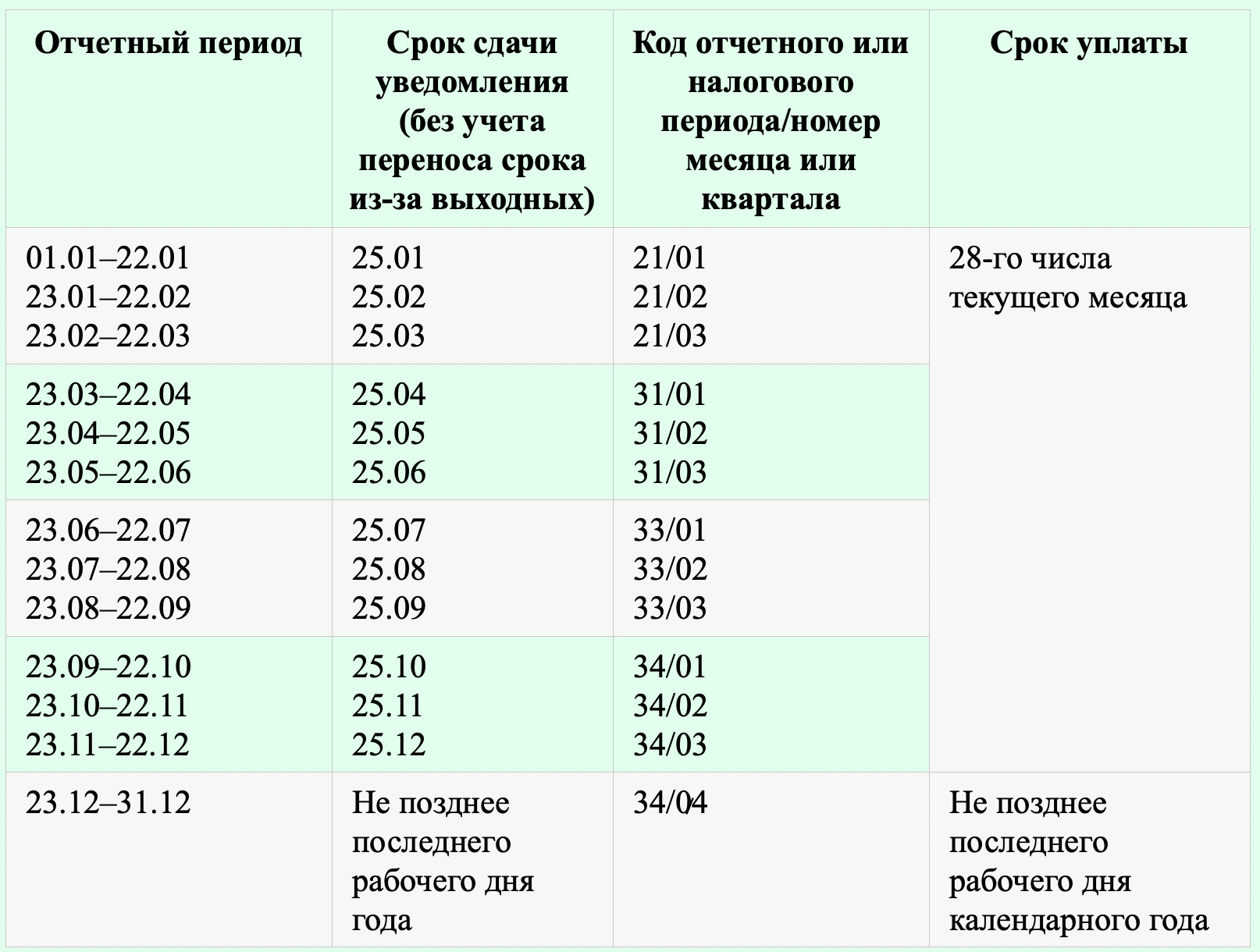

The procedure for paying insurance premiums is also defined by Russian law. Individual entrepreneurs are required to make quarterly payments to the Federal Tax Service (FTS). The deadlines for these payments are April 15th, July 15th, October 15th, and January 15th of the following year. Payments can be made through various methods, including online banking, bank transfers, or in person at FTS offices.

Failure to pay insurance premiums on time or in full can result in penalties and fines. Individual entrepreneurs who have outstanding debts may also be denied access to certain government services and benefits. Therefore, it is essential for individual entrepreneurs to stay informed about the regulations and deadlines for paying insurance premiums to ensure compliance and protect their rights.

Table of Insurance Premiums for Individual Entrepreneurs in 2024:

| Type of Insurance | Fixed Portion (Rubles) | Variable Portion (%) | Maximum Income Limit (Rubles) |

|---|---|---|---|

| Pension Insurance | 36,792 | 10% | 365,524 |

| Medical Insurance | 8,766 | 5.1% | 286,676 |